nebraska property tax calculator

Registration Fees and Taxes. Its important to note that some items are exempt from sales tax in Nebraska including prepared food and related ingredients.

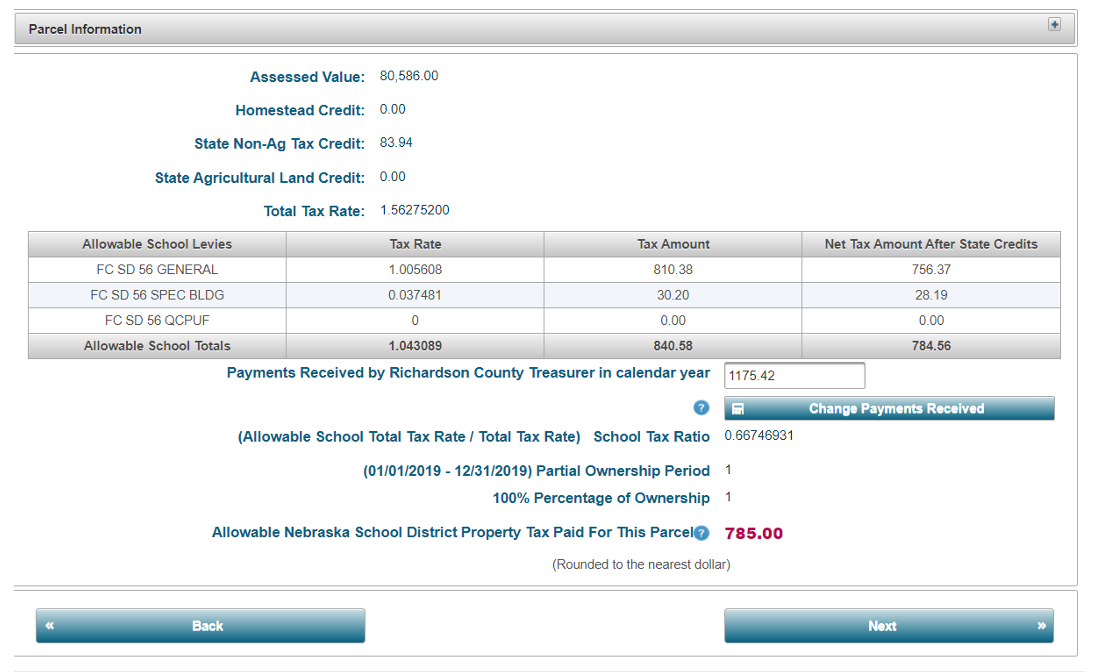

Nebraska Launches Online Property Tax Credit Calculator

Important note on the salary paycheck calculator.

. The median property tax in Nebraska is 216400 per year for a home worth the median value of 12330000. Nebraskas state income tax system is similar to the federal system. Our Sarpy County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax.

The Nebraska tax calculator is updated for the 202223 tax year. If you make 70000 a year living in the region of Nebraska USA you will be taxed 12680. The Nebraska Department of Revenue DOR has created a GovDelivery subscription category called Nebraska Property Tax Credit Click here to learn more about this free subscription.

Driver and Vehicle Records. Counties in Nebraska collect an average of 176 of a propertys assesed fair. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and.

As of 2019 the Nebraska state sales tax rate is 55. This marginal tax rate means. Nebraska property tax calculator get link.

Nebraska provides refundable credits for both school district and community college property taxes paid. The NE Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for. For comparison the median home value in Nebraska is.

AP Nebraska taxpayers who want to claim an income tax credit for some of. Its a progressive system which means that taxpayers who earn more pay higher taxes. There are four tax brackets in.

Each credit is equal to a distinct percentage multiplied by either the school district. For example lets say that you want to purchase a new car for 60000 you. Nebraska launches new site to calculate property tax refund.

Your average tax rate is 1198 and your marginal tax rate is 22. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. You can calculate the sales tax in Nebraska by multiplying the final purchase price by 055.

California Property Tax Calculator Smartasset

How Are Property Taxes On New Construction Homes Calculated

Nebraska Mortgage Calculator With Taxes And Insurance Mintrates Com

State Mansion Taxes On Very Expensive Homes Center On Budget And Policy Priorities

State Tax Levels In The United States Wikipedia

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Douglas County Sets Property Tax Rate Likely Costing Homeowners More Money

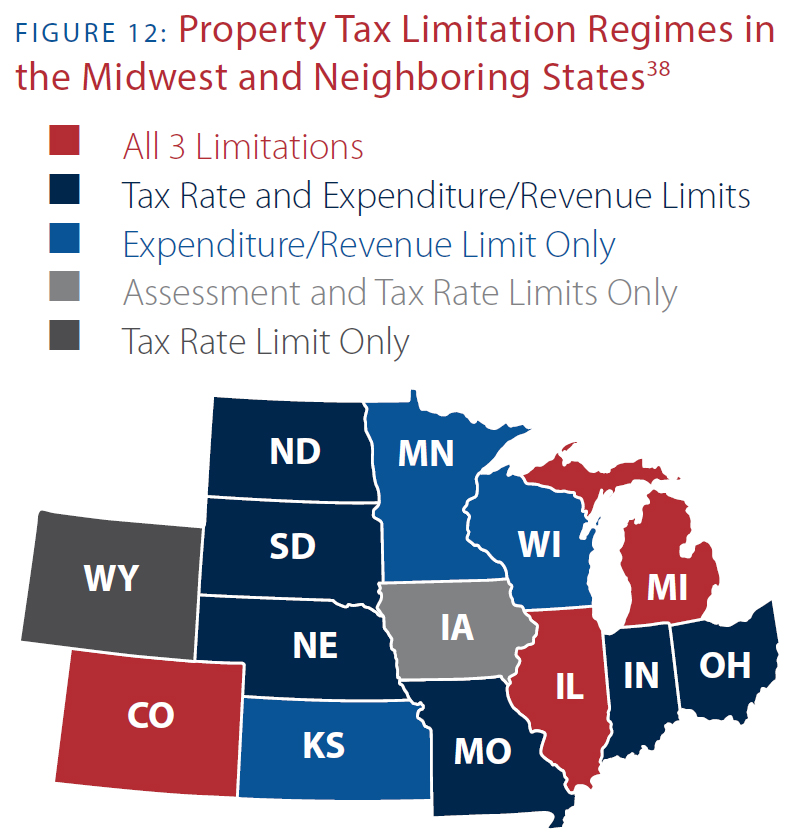

Property Tax Relief Through State Income Tax Center For Agricultural Profitability

Property Tax Reform Is Focus Of Nebraska Hearing Brownfield Ag News

Property Taxes By County Interactive Map Tax Foundation

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Property Taxes By State Embrace Higher Property Taxes

Omaha Property Taxes Explained 2022

Nebraska Property Tax Calculator Smartasset

Nh Had Seventh Highest Effective Property Tax Rate In 2021 Report Says Nh Business Review