reit dividend tax south africa

Any REIT dividend excluding a share buy-back from a company that is a REIT at the time of the distribution of that dividend but including interest paid on a debenture forming part of a linked. South African REITs own several kindof commercial s such asproperty shopping centres office buildings factories warehouses hotels hospitals.

The Reit Stuff How Reit Etfs Can Send Your Dividends Through The Roof Nasdaq

In terms of Reit tax laws that came into effect in 2013 JSE-listed property funds must pay out 75 of their taxable income to investors in order to be a Reit and benefit from not.

. The provisions in the Income Tax Act No. This creates an issue that individual investors in REITs are not able to receive the benefit of the reduction in the. An understanding of the REIT structure is necessary.

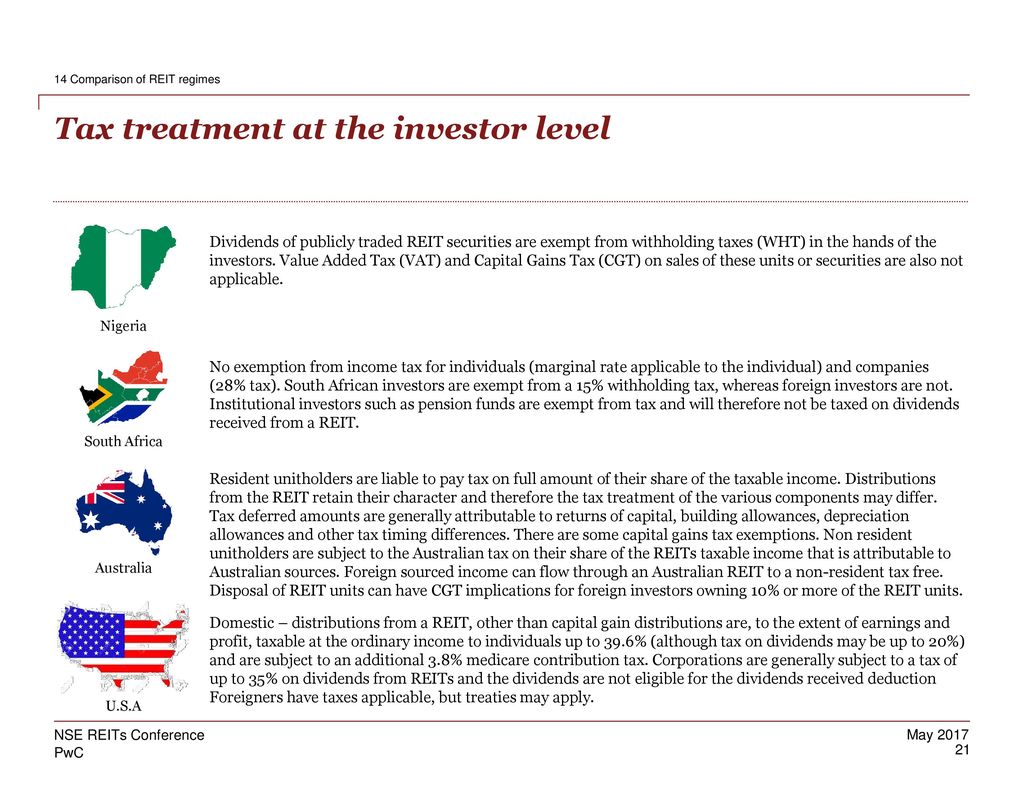

A South African tax resident natural person investing in a REIT will be subject to income tax on dividends received by or accrued from a REIT at a maximum rate of 40. Distributions from REITs must be included in the taxpayers taxable income and will be taxed. This is a listed property investment vehicle.

In South Africa a REIT. REIT Dividends received by South African tax residents must be included in their gross income and will not be exempt. A REIT stands for Real Estate Investment Trust.

Received by a non-resident from a REIT will be subject to dividend withholding tax at 15 unless the rate is reduced in terms of any applicable agreement for the avoidance of double taxation. REIT Dividends - South African tax resident shareholders. Reit Dividends Tax.

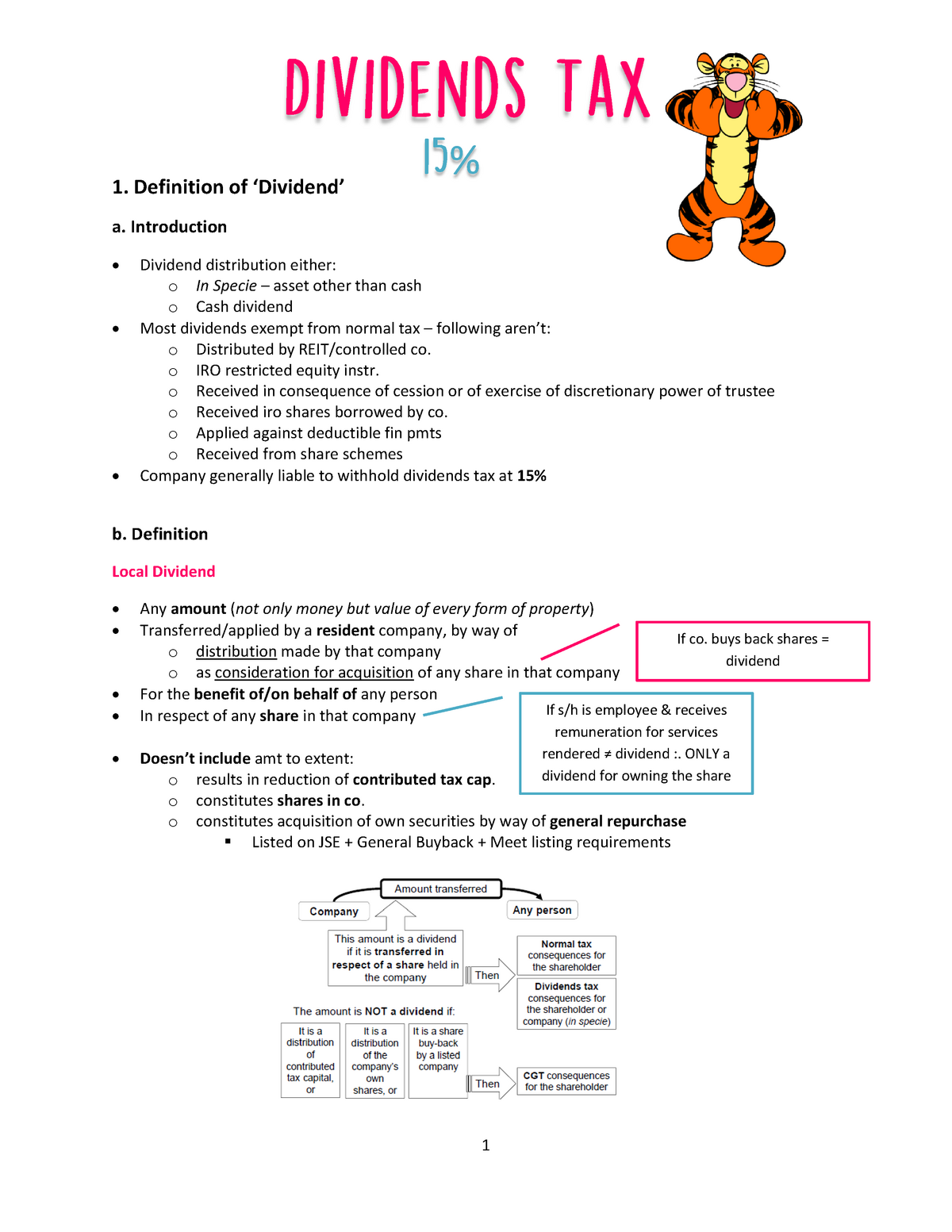

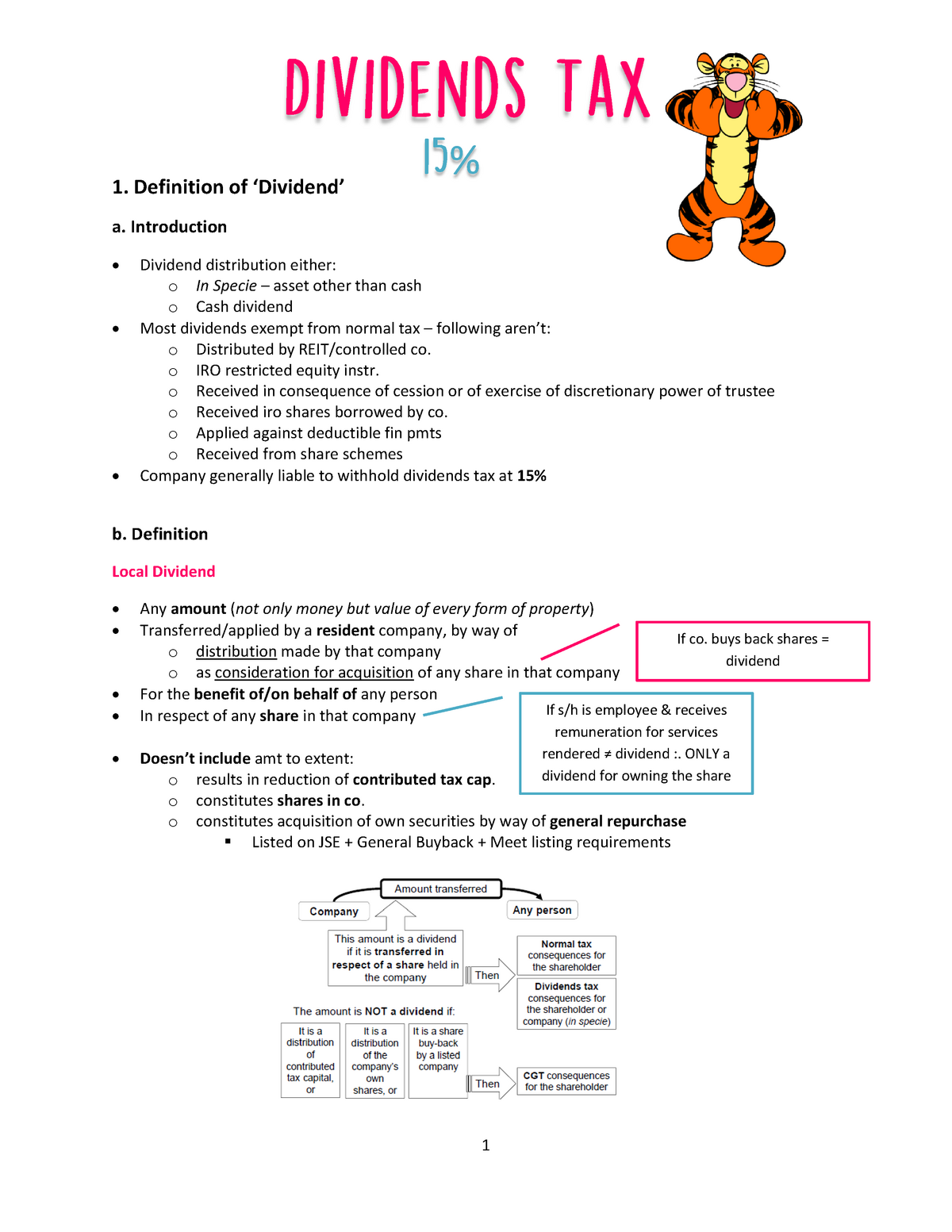

Property owning subsidiaries of REITs also benefit from the section 25BB tax dispensation. To qualify for the South African REIT dispensation a the REIT either a company or a trust must be tax resident in South Africa and be listed as an REIT in terms of the JSE Johannesburg. 58 Dividends Tax sections 64E1 64F1.

Foreign shareholders of SA REITs are levied a dividend withholding post tax at. Recharacterisation of interest distributions. Ignoring commercial considerations in relation to this fairly common occurrence often the shareholders of the target company in these circumstances would be motivated for.

Forex gains that do not fall within the rental income definition recently amended. A Real Estate Investment Trust REIT is a company that derives income from the ownership trading and development of income producing real estate assets. 1 July 2020 Dividends Tax Declaration and undertaking validity limited As from 1 July 2020 the validity of the declaration and undertaking forms submitted to withholding agents could be limited to only five years from the date the declaration was made and unless a new declaration and undertaking is made the exemption or reduced rate may no longer be applicable.

1 August 2015 at 1643 Hello I have received a Tax Certificate from my stock broker and it says Total. Posted 2 August 2015 under Tax QA Peter says. The recent significant volatility in the Rand may result in REITs or CCs having large forex gains.

Interest distributions by a REIT or a controlled property company payable to South African resident investors are recharacterised. For listed property companies to maintain their REIT status they must pay a minimum of 75 of their taxable earnings available for distribution as a REIT dividend each year within a period of four months after its year-end. 13 Oct 2014 0010.

As from 1 April 2012 dividends tax is charged at 15 on shareholders when dividends are paid to them by a South African tax resident company or Foreign Company. Investing in SA REITs. Be subject to a 20 dividends tax which is in fact a tax on the investor.

How your listed property holding will be taxed. 58 of 1962 the Act pertaining to the taxation of Real Estate Investment Trusts REITs are contained in section 25BB and were. Dividend tax treatment and salient dates DIPULA INCOME FUND LIMITED Incorporated in the Republic of South Africa Registration number 200501396306 JSE.

CAPE TOWN By the middle of this year most of South Africas listed property. REIT investments and tax.

Sa Reits Tax Benefits For Investors Sa Reit

The Hines Funds Universe Download Scientific Diagram

How Reit Regimes Are Doing In 2018 Ey Slovakia

Pdf Introduction Of Reits In South Africa Transformation Of The Listed Property Sector

Dividends Tax Notes 1 Definition Of Dividend A Introduction Dividend Distribution Either O Studocu

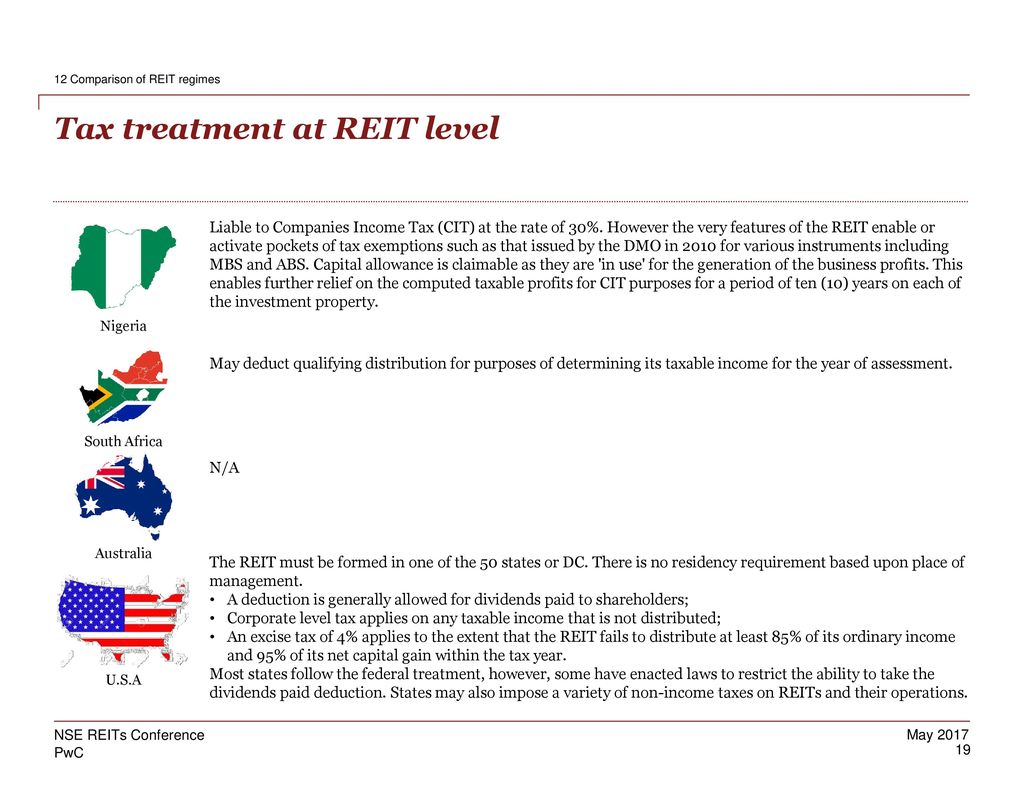

Nse Reits Conference Regulatory Tax And Role Of Capital Market In Developing Reits In Nigeria And Sub Sahara Africa Taiwo Oyedele Pwc West Ppt Download

Real Estate Investors Face Dividend Drought

South Africa Reits Investing Offshore International Tax Review

Dividend Withholding Tax Rates By Country For 2021 Topforeignstocks Com

Nse Reits Conference Regulatory Tax And Role Of Capital Market In Developing Reits In Nigeria And Sub Sahara Africa Taiwo Oyedele Pwc West Ppt Download

South Africa Reits Investing Offshore International Tax Review

Descriptive Statistics For Reits That Report Funds From Operations Download Table

Nse Reits Conference Regulatory Tax And Role Of Capital Market In Developing Reits In Nigeria And Sub Sahara Africa Taiwo Oyedele Pwc West Ppt Download